We remove barriers when you pay suppliers overseas.

Join 1,000,000+ small and medium-sized businesses worldwide to streamline your cross-border payments and save money and time on it.

- Pay to 200+ countries in 30+ currencies

- ACH, wire transfer, Credit card, In-network transfer, and more

- Access to market-leading FX rate

- Bank-level security and encryption

PingPong empowers businesses to grow globally.

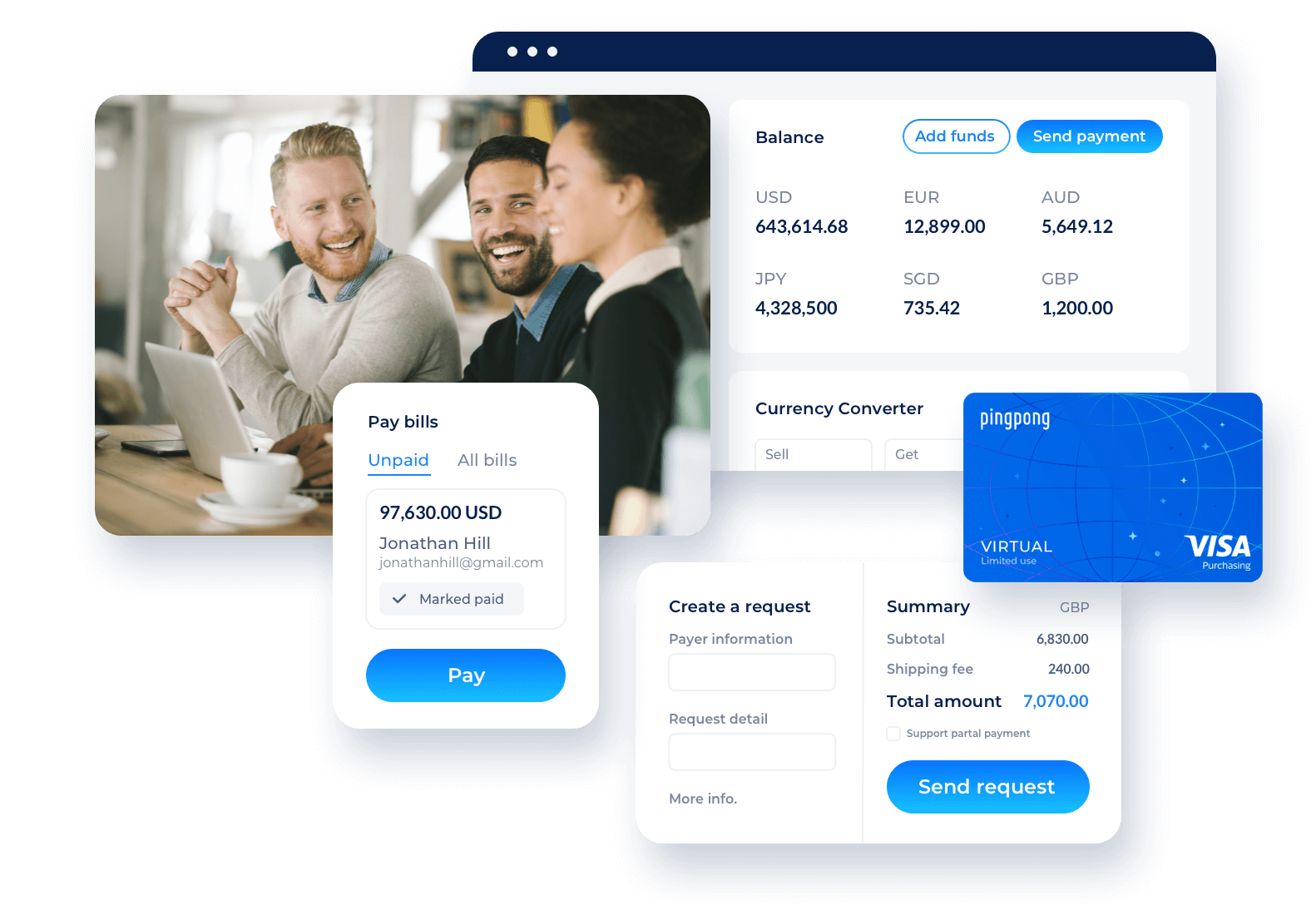

Pay Suppliers

Pay your suppliers and vendors straight from your PingPong account. Track all your transactions in real-time.

Request Payments

Request and receive payments in various local currencies directly into your free PingPong virtual account.

FX Solution

Convert currencies at the lowest industry rates — significantly cheaper than banks. Support 30+ currencies worldwide.

Smart Accounting

Integrate your accounting and other financial management tools into your PingPong account.

Send and receive payments

anywhere, everywhere.

Send payments in 11+ major currencies with free virtual accounts.

Create a free account to send payments to vendors worldwide as smoothly as with a local bank account.

Request payments from clients around the world hassle free.

Customize and send invoices in just a few minutes, track payment progress and receive money instantly.

Streamline your payment processing.

Mass pay freelancers and contractors effortlessly.

Tap into the global talent market without having to worry about international transactions.

Manage suppliers in a single dashboard.

Effortlessly onboard suppliers, contractors, and other business entities with simple entry.Grow, scale and prosper with PingPong.

One-stop foreign exchange solution for global clients.

Manage and minimize your exposure to foreign exchange market risks with PingPong’s comprehensive FX solutions, featuring real-time and secure online currency exchange options.

Automate payment management by syncing PingPong with QuickBooks.

View and manage all your payments in one place by linking your PingPong and QuickBooks accounts together.

What our customers say

“Ultimately, we needed a trusted payment provider with whom we didn’t have to worry about whether we were getting the best rate. With PingPong we could trust that we were getting a good deal; today, tomorrow, forever, with a system that would work; today tomorrow forever.”

“Everything between PingPong and Citi started from a basic cash account in the U.S. and expanded into over 230 accounts in more than 20 countries. As of today, PingPong has become one of our Platinum clients.”

“When a merchant pays for goods in CNY instead of USD, we’re able to offer them a better rate for the total wholesale cost of the inventory they’re purchasing. We don’t have to spend time converting the USD, and we do not lose money in fees. Our customers are happier because they receive the lowest supplier payment deal possible.”

PingPong prides itself on enabling SMBs to

keep more of their hard-earned profits.

Combat Card

-

Speed

-

Transaction fees

-

Exchange rates

-

Payment tracking

-

Security verification

-

Payment efficiency

Traditional Banks

Costly

-

2 - 7 day settlement period

-

High fees around 3 - 5 %

-

Large spread

-

Not supported

-

Not supported

-

Inefficient payment processes

PingPong Payments

Win

-

Same day or next business day

-

0% - 1% all-inclusive transaction fees

-

Competitive exchange rates

-

Supported

-

Supported

-

Accelerated payment process

Frequently Asked Questions

How does PingPong FX actually work?

We’ve partnered with Tier 1 banks around the world like Citibank, Wells Fargo, Barclays, etc. to establish virtual accounts in all major currencies. They’ve licensed these accounts to us, which we then sublicense to our clients.

This means that instead of Amazon (or other marketplaces) automatically converting your international earnings back into your native currency, they can disburse those funds in the currency/country in which it’s earned.

For example, if you’re an American company selling on Amazon Canada, you can have those funds disbursed to your PingPong Canada account in Canadian dollars. From there, you can take advantage of PingPong’s lower FX rates to put more of those earnings into your pocket when you convert back into your native USD currency.

Where is PingPong based?

PingPong was founded in New York City in 2015 and we have offices in 5 countries around the world. Our global HQ is in China. Our US office is based in San Francisco.

How much does PingPong Charge?

PingPong has some of the most aggressive pricing in the e-commerce industry when it comes to foreign currency conversions. We never charge more than 1%.

Is my money secure with PingPong?

Yes! PingPong is a fully licensed Money Service Business (MSB), and we follow the strict guidelines set by the governing body in every country we operate in.

In the US our clients' funds are backed by Surety Bonds equal to 100% of the balance out in every state, and held in our FDIC insured partner banks for safe keeping.

Why do you request so many documents in order to approve our business account?

As a Money Service Business (MSB) we are heavily regulated and have to collect a lot of information (KYC aka Know Your Client documentation) to ensure that we are working with legitimate businesses and their owners.

Articles of Incorporation, Letters from the IRS with EIN/Tax ID Proof, & Driver’s Licenses/Passports are some of the easiest ways to identify and confirm the true business owners’ identities.

Can I pay my international suppliers via PingPong?

Yes! You can add funds to your PingPong account or use your existing funds on balance to make payments all over the world in almost every currency.

If your supplier/receiver also has a PingPong Account then you can utilize the in network payment and the funds will arrive almost instantly and the payment costs nothing!

SITUATION

The company’s production takes place in various parts of the world. Import costs were soaring, and supplier relationships were becoming more complicated.

SOLUTION

By onboarding PingPong, Budsies was able to save more in foreign exchange fees alone. This significant reduction in fees was a game-changer for the company

IMPACT

Now, through PingPong’s payment system, Busides can easily process payments to over 1,500 suppliers, this whole process has become automated.

Our bank partners

Power Your Entire

Payment Operations.

Let’s get more productive. PingPong delivers smart payment solutions that elevate modern business. Let’s bring scale, efficiency, and focus to your business through fully automated, end-to-end solutions.

- Eliminated Wires Fees

- Saved Time from Processing Wires

- Streamlined Supplier Payment Process

.png?width=211&height=80&name=Budsieslogo-with-tagline_HuggableWorld_gray_noStroke_3000%20(1).png)